Homeownership Process

Our Habitat Homebuyer Application round is currently closed. If you are interested in being notified when we open our next round, please fill out the inquiry form below. Once you complete the form, your information is stored in our system, so please only complete the form once per person.

Application Notification Form

About our Program:

Building Hope and Homes…One Family at a Time

Fort Collins Habitat for Humanity is an affordable homeownership program. Our goal is to help households living on modest incomes realize the full financial and social benefits of owning their own home. Additionally, each Habitat Homeowner has the satisfaction of knowing that their monthly mortgage payments contribute to building even more homes for future Habitat Homeowners.

*Please Note: Application availability is subject to change or cancellation depending on the prior selection round, land availability, sponsorship and other events beyond our control. We apologize for any inconvenience this may cause.

Please direct your questions to our Homeowner Services Director at (970) 488-2605.

Step-by-step Process to becoming a homeowner

- Residency

Live or work in Fort Collins (or surrounding rural areas), are a US citizen, or a legal permanent resident

- Need of Housing?

- Current shelter is inadequate — structural defects, lack of heat, maintenance problems, etc

- Temporary or transitional housing — living with friends or family

- Household is overcrowded (number of persons in each bedroom, number of persons sleeping in rooms other than bedrooms)

- Environment is inadequate — household feels unsafe

- Household currently pays more than 30% of total gross monthly income for housing

- Unable to purchase a home through any other means

- Ability to Pay

- Able to save $1,500 toward closing costs

- Must have had any bankruptcy filing discharged 2 years prior to applying for a FCHFH home

- Monthly debt plus monthly housing cost is less than 40% of gross monthly income

- No outstanding liens or judgments

- Cannot have owned a home within the last 3 years (with the exception of mobile homes)

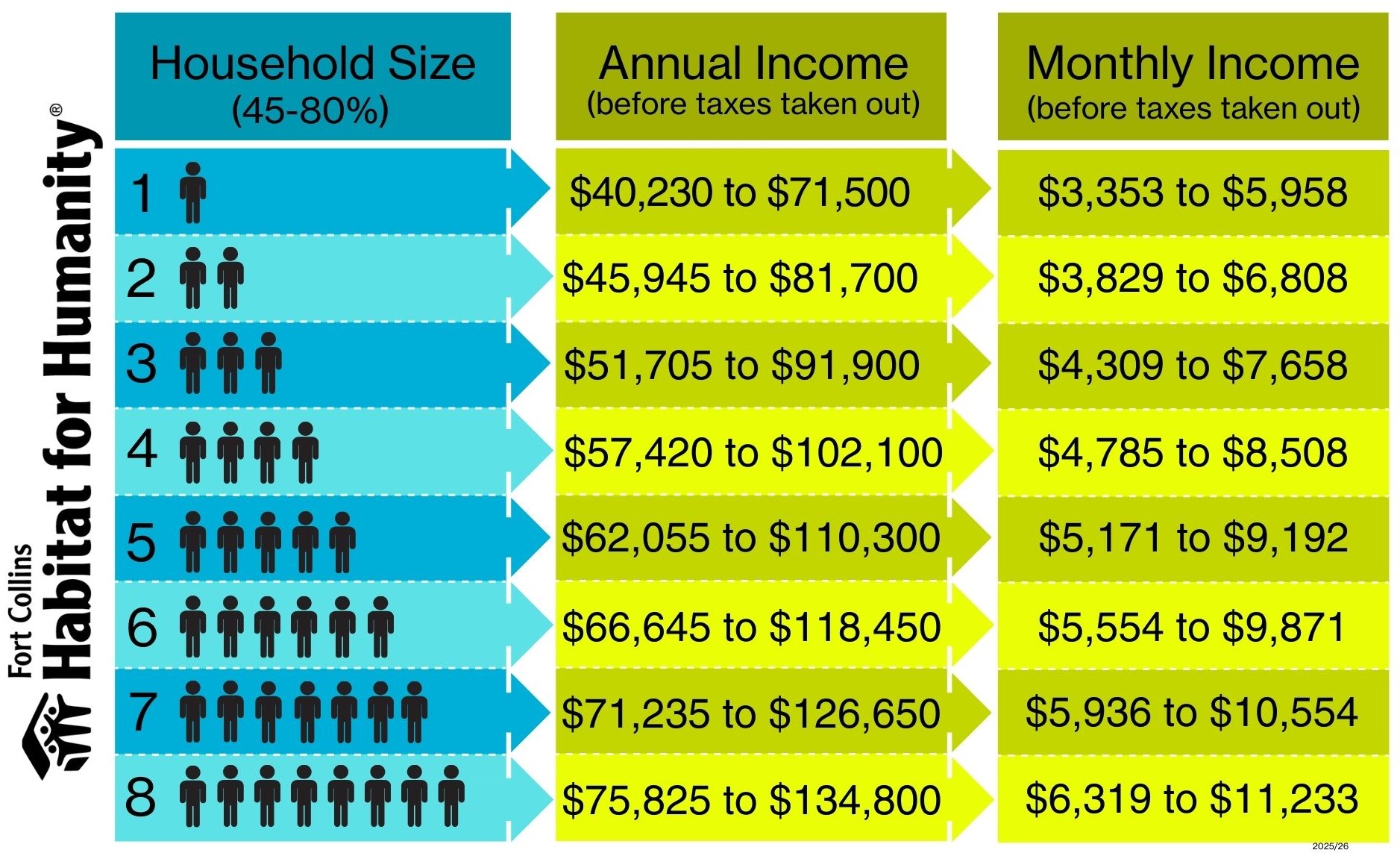

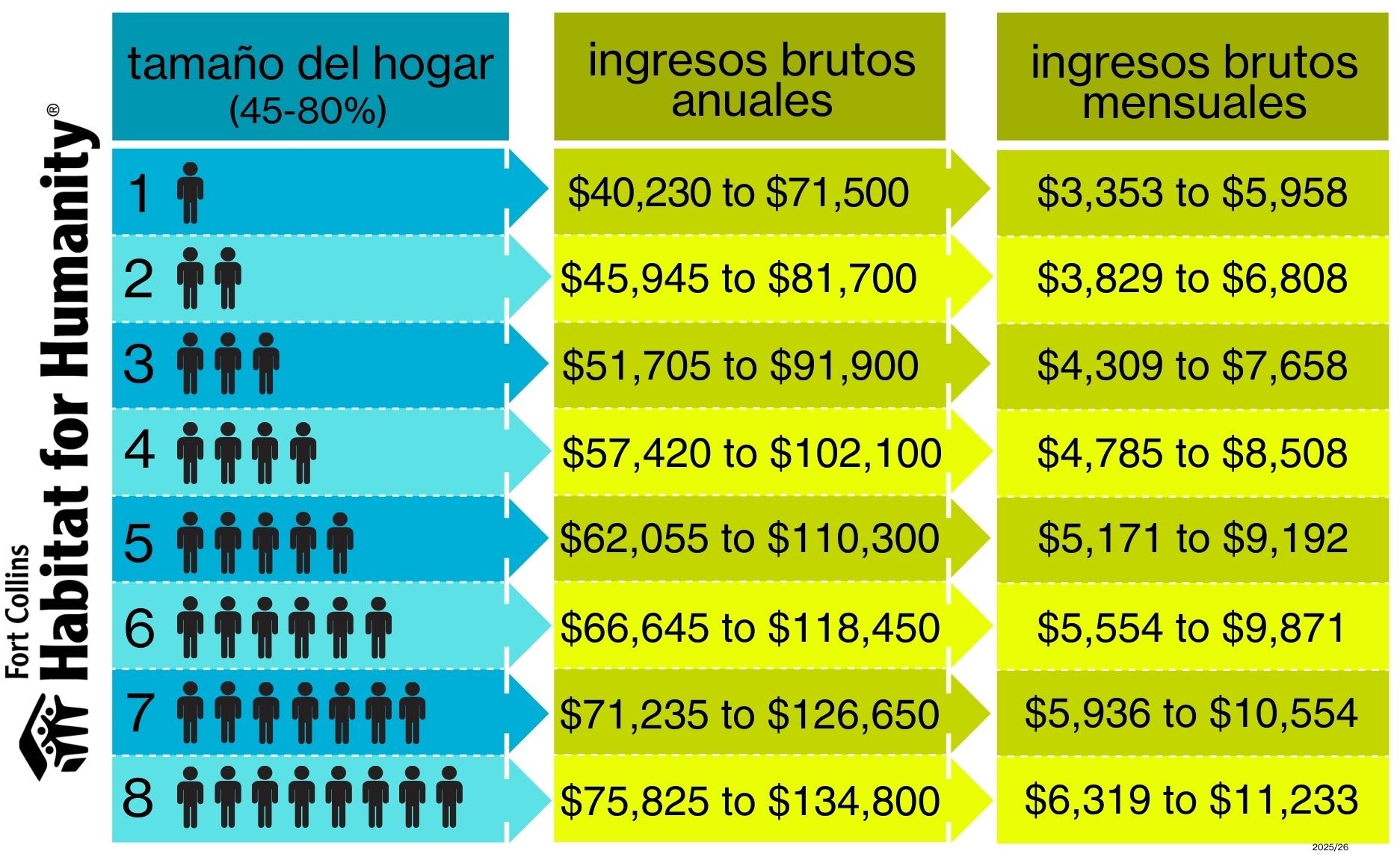

- We serve individuals and households earning between 45-80% of HUD’s area median income. (Refer to guidelines below, broken down by monthly and annual income.)

- If you are married, both you and your spouse must apply as Applicant and Co-applicant.

- If you are contemplating divorce or are in the process of a divorce, the divorce must be finalized before applying with Habitat